Why Is Risk Tolerance Questionnaire Not Enough?

Many advisors use a traditional Risk Tolerance Questionnaire (RTQ), such as the Grable & Lytton risk assessment.

However, using RTQ may get you to a reasonable ballpark but it is not enough, because it has serious limitations.

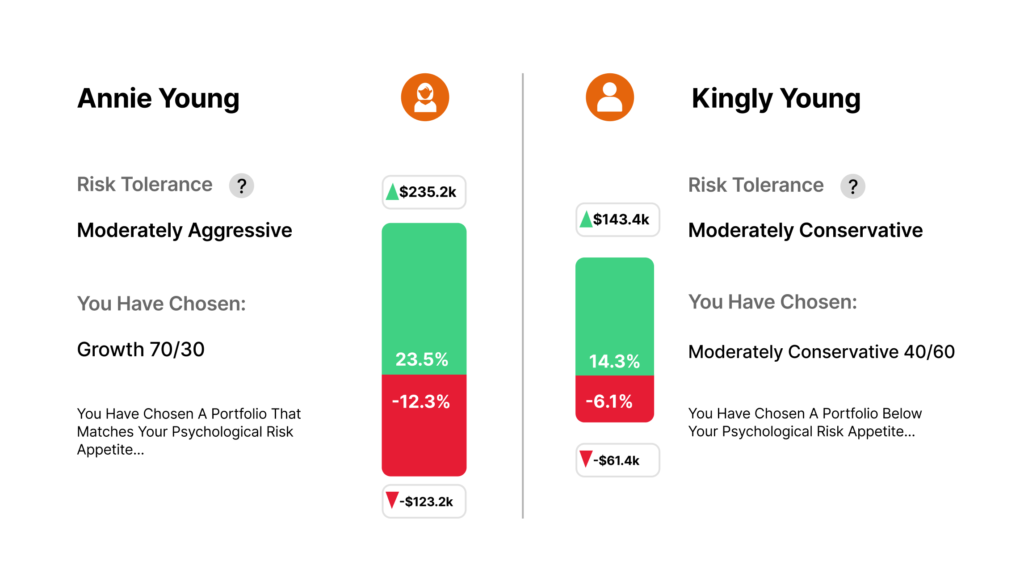

- It often doesn’t explicitly state that investors can lose money and how much.

- It is often mixed with other things, such as time horizon, and behavioral biases.

- It doesn’t directly map to advisor’s models.

Reimagine Risk Tolerance Assessment

Most risk tolerance tools are cookie-cutter solutions, but our Risk Tolerance Test allows you to plug in your own models, so the result maps directly one of your models. It is the most intuitive, direct and defensible approach.

To ensure accuracy, it is cross-validated with a traditional risk tolerance questionnaire.

Stand Out With Us

What If I Want A Risk Score of 0-100?

It is satisfying to have a risk scale of 0-100. It can be easily obtained by multiplying volatility (standard deviation) by five.

Using this simple algorithm, you will find that the risk score is usually close to the percentage of equity in the asset allocation. For example, the risk score of the 60/40 portfolio is close to 60.

This article explains in detail.

This is much more than a risk profiling system.

This is truly a holistic risk profiling approach, grounding the entire client onboarding process with long term value.

Want to learn more? Submit the form to get in touch today.